A basic guide to understanding home improvement loan calculators

You’ve put together a list of the home improvements you would like to pursue. It’s now time to calculate the costs and figure out financing. Interested in a home improvement loan? Using a home improvement loan calculator works to your best interest. Here’s how:

What are home renovation loans?

Home improvement loans are specifically utilized for home improvement projects. These loans are unsecured and perfect for smaller projects like upgrading your bathroom. Home equity loans, by contrast, are secured and are typically used for larger projects, such as adding on an additional room.

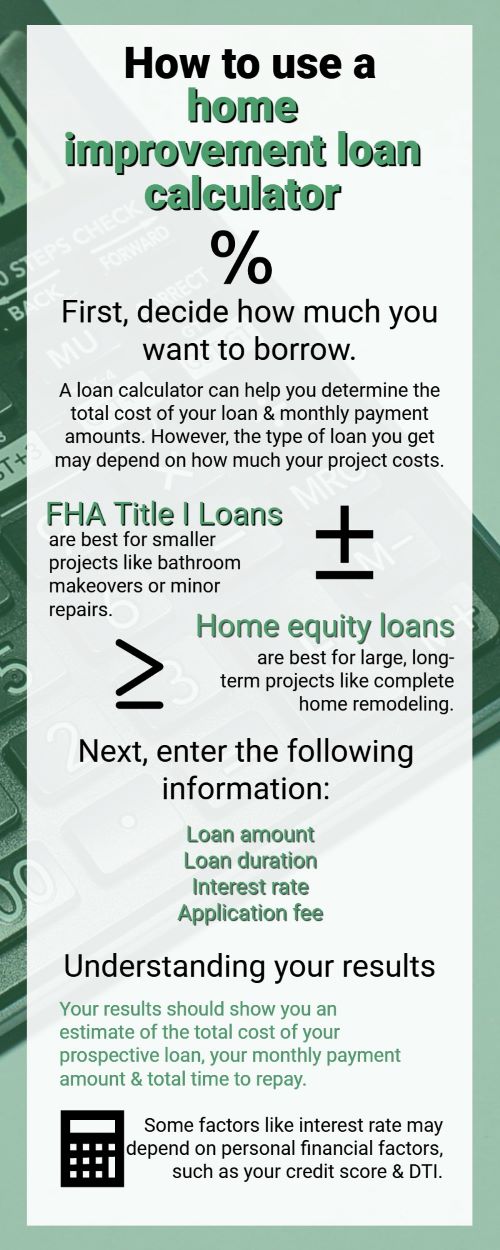

Using a home improvement loan calculator

A home improvement loan calculator is simple to use. You enter the amount you would like to borrow, along with the potential loan duration and interest rate. Then, you enter the percentage of the application fee.

Once you enter these items of information, it will give your loan results in a table. This table will indicate the cost required to pay off the loan, monthly payment, APR and interest.

Home improvement loan calculator results

The results of the calculator reveal some important aspects of your financing. It calculates your monthly payment and the amount of interest you have to pay over the duration of the loan. This interest rate is based on a number of factors including credit score, loan term and loan amount.

How to get a home improvement loan

Before applying for a home improvement loan, consider the cost of the project you wish to start. If the project is larger, a home equity line of credit can be a great option. This particular loan allows for you to borrow up to 85% of your home’s total worth. If your project is smaller, a Title I home improvement loan may be a better fit. Speak with a lender to learn more.

Home improvement projects can be a challenge, but the right tools can help them go smoothly. Using a home improvement calculator and having the right lender on your side is key.

About the Author

Linda Cappello, Broker, GRI, ABR

Linda A. Cappello, Owner/Broker of Cappello Realty Shoreline Properties. Cappello Realty is a full service boutique Real Estate firm that specializes in 06855 - East Norwalk, and services all of Norwalk and Fairfield County, CT. Linda has been in the Real Estate business for 20+ years, spending 18 of them as a Owner/Broker. Being a Broker adds a lot responsibility to her job. She is responsible for overseeing every transaction and agent in the office. This is a challenge that she looks forward to and takes very seriously. She is constantly taking continuing education classes and attending seminars to keep abreast of the ever changing market as well as the industry standards, rules and regulations.

She is a native to East Norwalk, and has an in-depth knowledge of the city that she loves, as well as the intricacies of the many unique neighborhoods and areas that Norwalk offers. Linda offers her clients a network of professionals ranging from Attorneys, Mortgage Brokers, Home Stagers and Home Inspectors to any and all pros that you may need for a successful transaction and for the convenience of her clients.

"My job doesn't end at the closing table. It goes far beyond that, keeping in touch and staying friends who refer their family and friends. A lot of my business is referral business which is the greatest accomplishment and honor of all. Earning my clients trust."